Equity Trade Update: $ON Closing Option Trade +8%

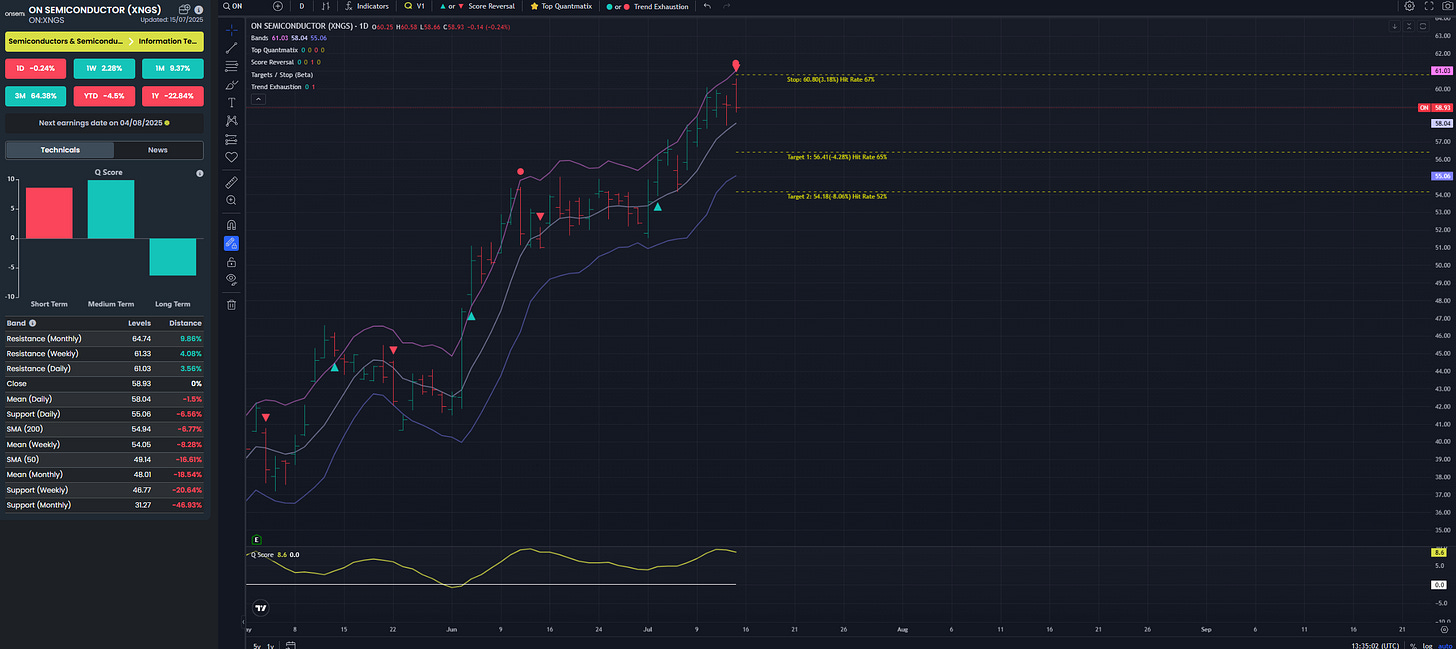

Negative Short Term Reversal & Trend Exhaustion signals

We posted this idea on 16th July and we hit target 1 today on 24th but stock took a bounce since then.

With expiry looming we are going to close our option trade at $4.50 for a small profit of 8%.

We didn’t get the push towards target 2 that we expected.

We had a negative Reversal signal and a Trend exhaustion signal in ON Semiconductor at the close last night

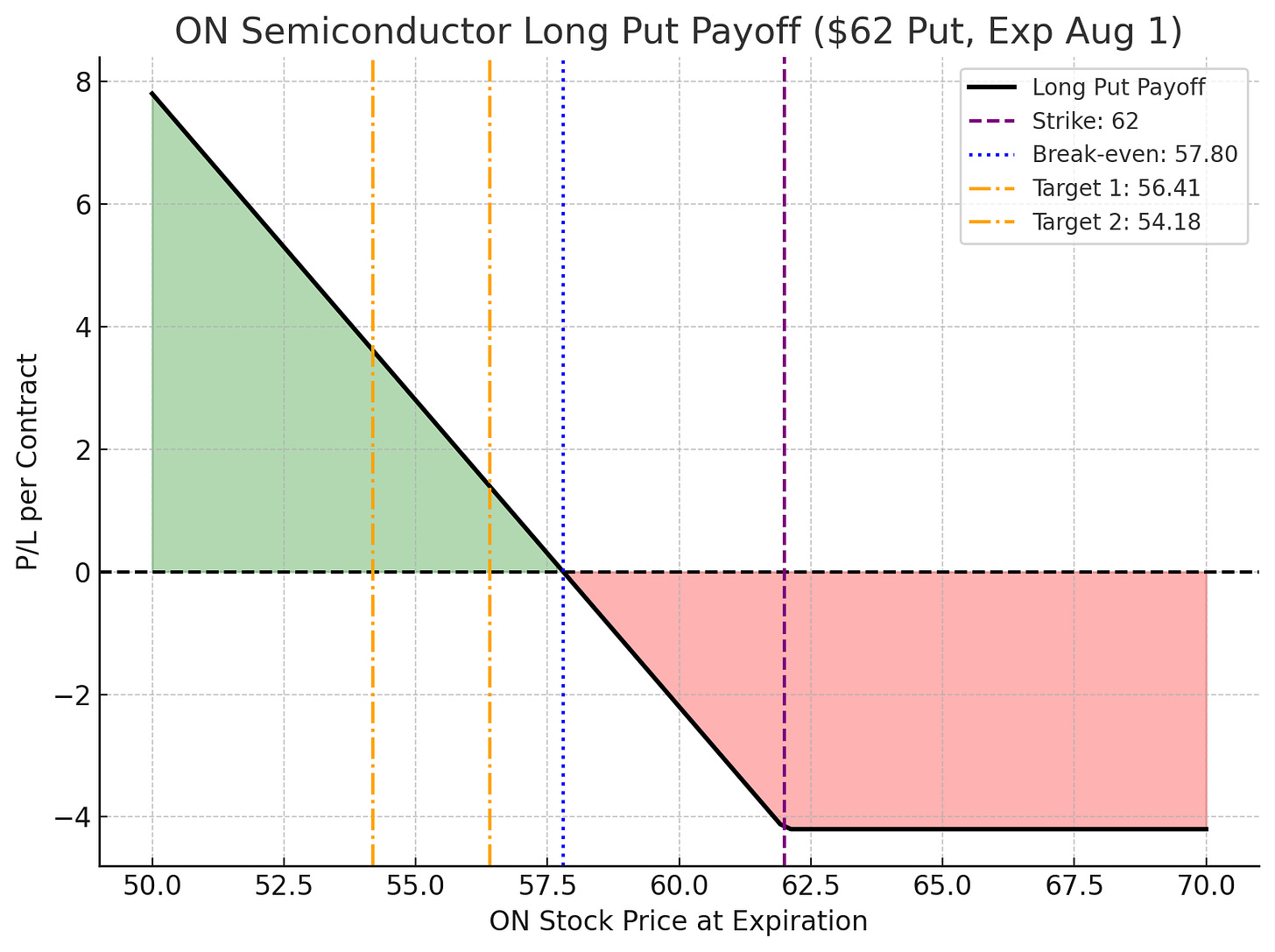

This trade idea focuses on a straightforward bearish setup on ON Semiconductor ($ON), using a long put strategy to position for further downside into early August.

Trade Setup

Buy ON $62 put

Net debit (cost): approx. $4.20

Max profit: Unlimited down to $0

Max loss: $4.20 (premium paid)

Break-even: $57.80 (62 - 4.20)

Expiration: August 1st

Current reference price: $58.76

Target Levels

Target 1: $56.41

Target 2: $54.18

Risk/Reward

Max Risk: Limited to premium paid ($4.20)

Reward Potential: High — profit grows as ON trades lower, breakeven at $57.80

📊 Payoff Diagram

Below is the payoff chart for this debit put spread, highlighting: