🔍 European Market Signals

Short-Term High Conviction Setups

As we head deeper into May, European equities are showing a cluster of short-term high conviction negative macro signals that warrant close attention. Below is a breakdown of the most compelling setups EURO STOXX Banks (SX7E), EURO STOXX 50 (SX5E), FTSE 100 (UKX), iShares MSCI Germany ETF (EWG), iShares MSCI Eurozone ETF (EZU)

📊 Indices

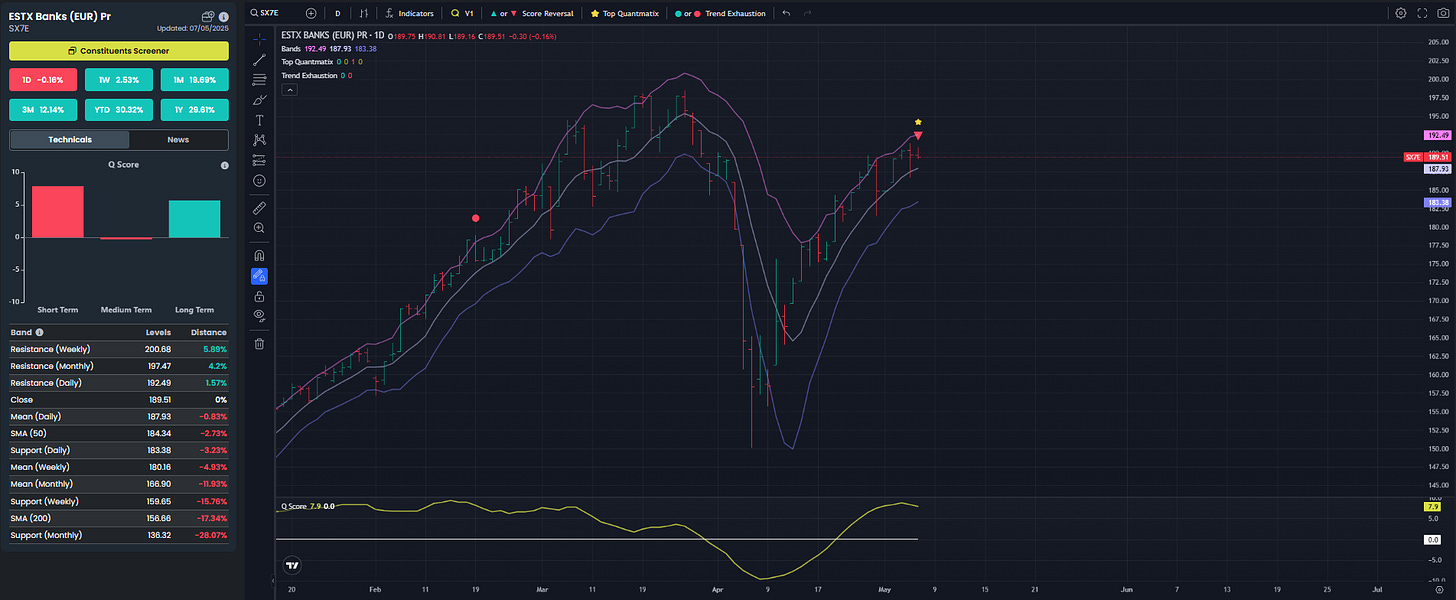

💥 SX7E – European Banks: Primed for a Pullback?

The EURO STOXX Banks index has been on a run year-to-date. But the short-term picture is flashing potentially overbought conditions:

Conviction Signal: High

Bias: Tactical bearish

Targets: 183.38 / 180.16

🔄 SX5E – EURO STOXX 50: Stalling at the Top

The broad European benchmark has been consolidating just below its recent highs.

Conviction Signal: High

Bias: Tactical bearish

Targets: 5136 / 5088

🏛 FTSE 100 – A Defensive Rebound in Play

Conviction Signal: High

Bias: Tactical bearish

Targets: 8355

🧺 ETFs

iShares MSCI Germany ETF (EWG): Risk to Downside

Conviction Signal: High

Bias: Tactical Bearish

Targets: 39.67 / 37.80

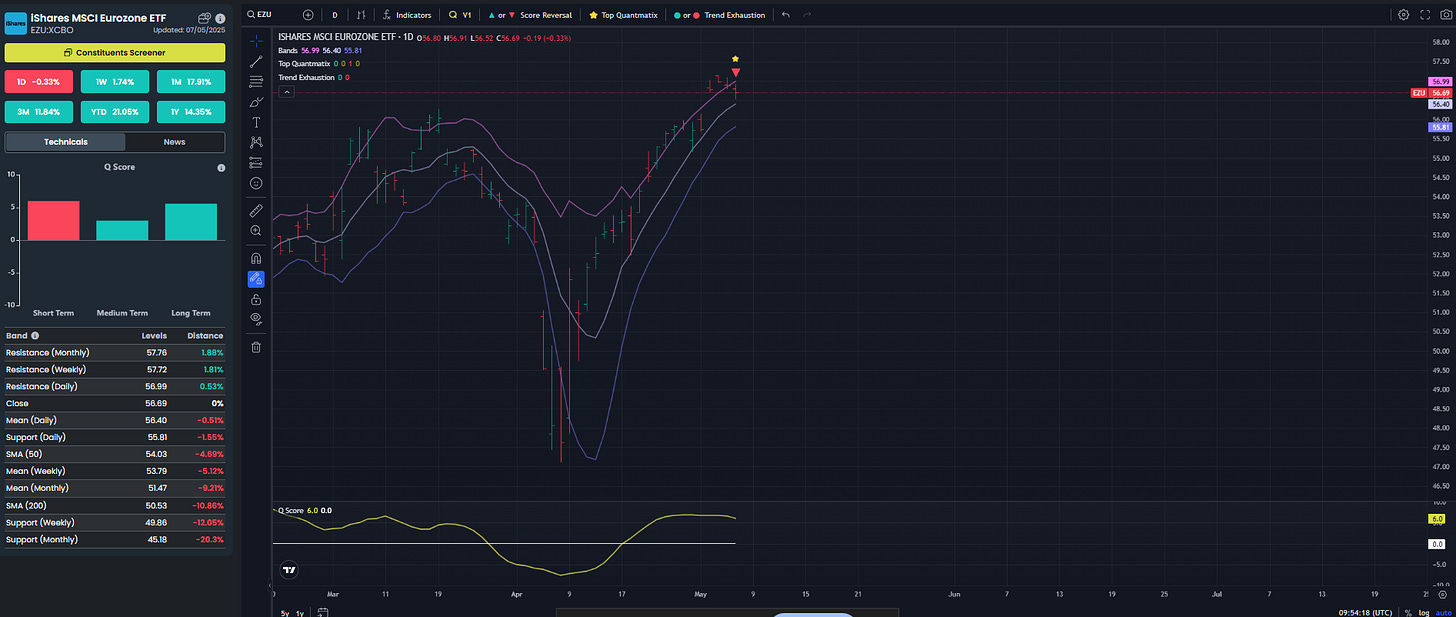

iShares MSCI Eurozone ETF (EZU)

Conviction Signal: High

Bias: Tactical Bearish

Targets: 54.03 / 53.79