📈 Markets Snap Losing Streak — But Is It Just a Bounce?

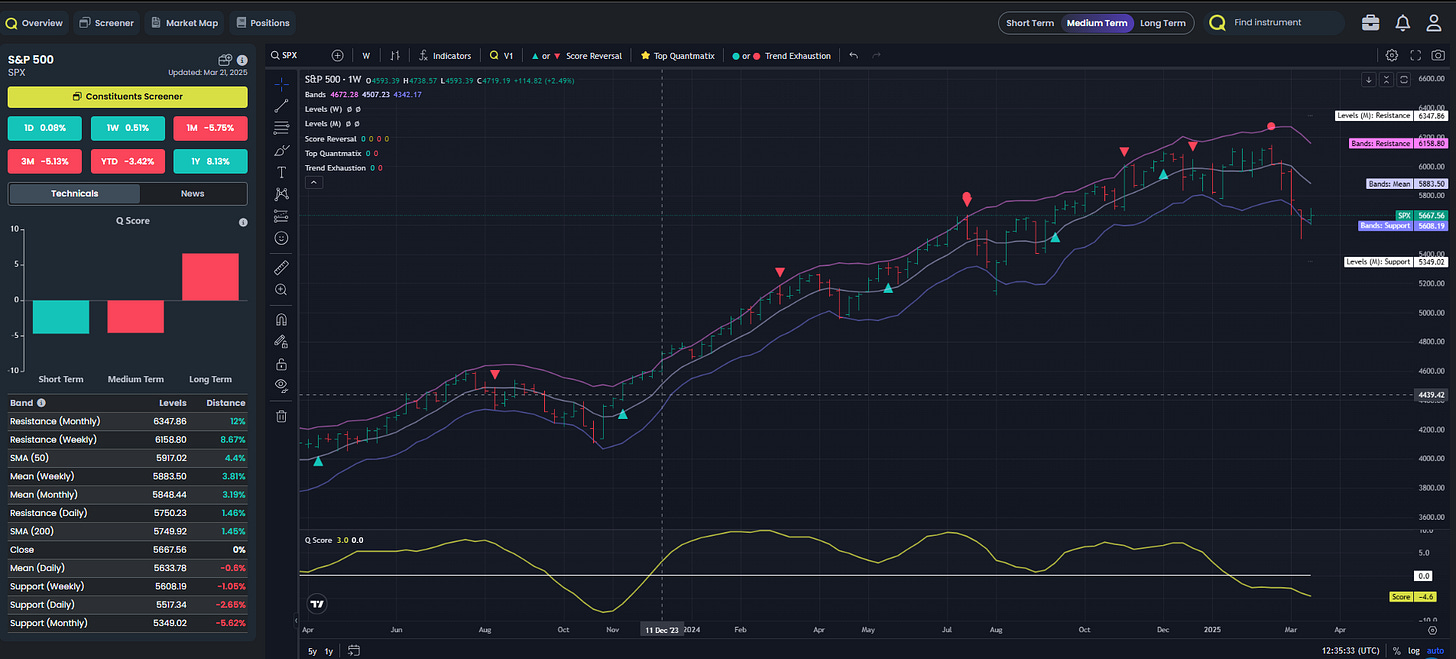

After four weeks of red, US equities finally found a footing last week — helped by a cluster of short-term positive signals flagged by Quantmatix around St. Patrick’s Day. But don’t let the bounce fool you: weekly score trends remain negative, and the medium-term view for US indices hasn’t shifted.

🔎 So What’s Next?

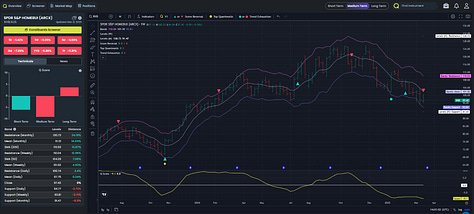

US Equities: Still under pressure. Daily signals have improved, but weekly trends haven’t. Watch SPX 5750 — key resistance lies there.

European Equities: Recently reversed lower (as expected), but this looks more like a healthy pullback in an overall uptrend.

India: Continues to lead. INDA ETF showing strong momentum.

Japan: On watch — several Topix sectors flashing early positive reversals.

Fixed Income: Diverging trends — US yields falling (Trump/DOGE risks?), European yields rising (German rearmament plans).

🌍 Global Macro Snapshot

Gold & Copper – very stretched at the top of their ranges

Silver – still positive, but less extended

Oil (WTI) – score very negative, but energy stocks turning up (possible early reversal)

USD – weak and range-bound

Europe vs. US – European sectors still showing structural strength despite near-term pullback

💡 Notable Trade Ideas This Week

✅ Positive Ideas

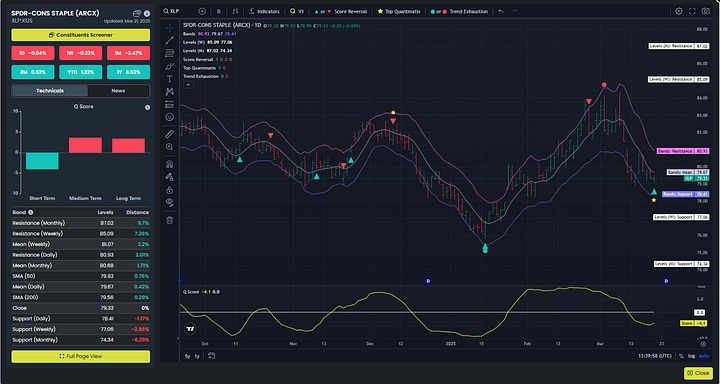

US Consumer Staples (XLP ETF)

India (INDA ETF) – still accelerating

Global Energy (FILL ETF) – quiet strength building

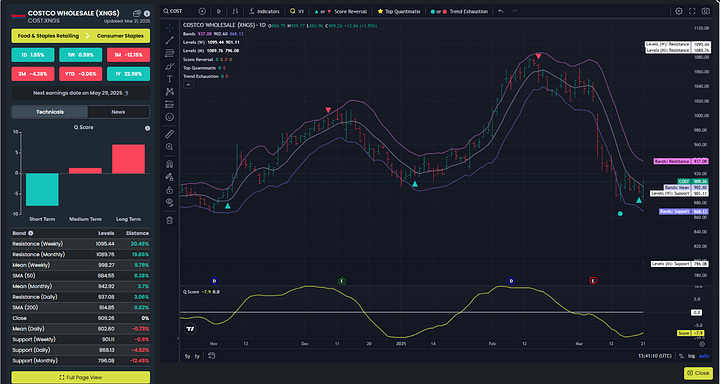

Costco (COST) – holding strong

❌ Negative Ideas

US Homebuilders (XHB ETF) – weekly trends confirmed negative

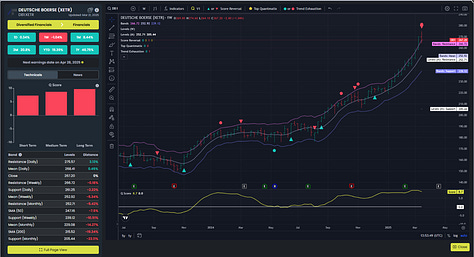

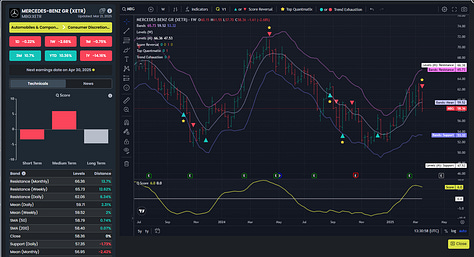

German Equities – DAX, Deutsche Boerse, Mercedes all reversing

Healthcare & Biotech – no follow-through from daily bounces

📌 Final Thoughts

Markets remain volatile and uncertainty is high, but the Quantmatix signals continue to deliver clarity when it matters most — guiding timing, stock selection, and broader asset allocation.

Keep following for key resistance levels and explore the high-conviction ideas on both sides of the tape.

More to come in this week.