Markets Update

📉 Moody’s Downgrade: Is 5% the Next Stop for U.S. 10-Year Yields?

Following Moody’s recent downgrade of the U.S. credit outlook, bond markets may be bracing for another leg higher in yields. Quantmatix levels for the U.S. 10-Year Treasury (USGG10) now highlight 4.75% as the next critical level, with a potential extension to 5.03%. The bond bears aren’t done yet.

📊 Equity Markets: The “Easy” Gains May Be Behind Us

U.S. and European equities are now flirting with key daily and weekly resistance levels. With more than 100 S&P 500 names trading outside their upper Quantmatix bands, the odds of a mean reversion pullback are rising.

Could the downgrade be the trigger for a broader market consolidation?

📈 Thematic Trends to Watch

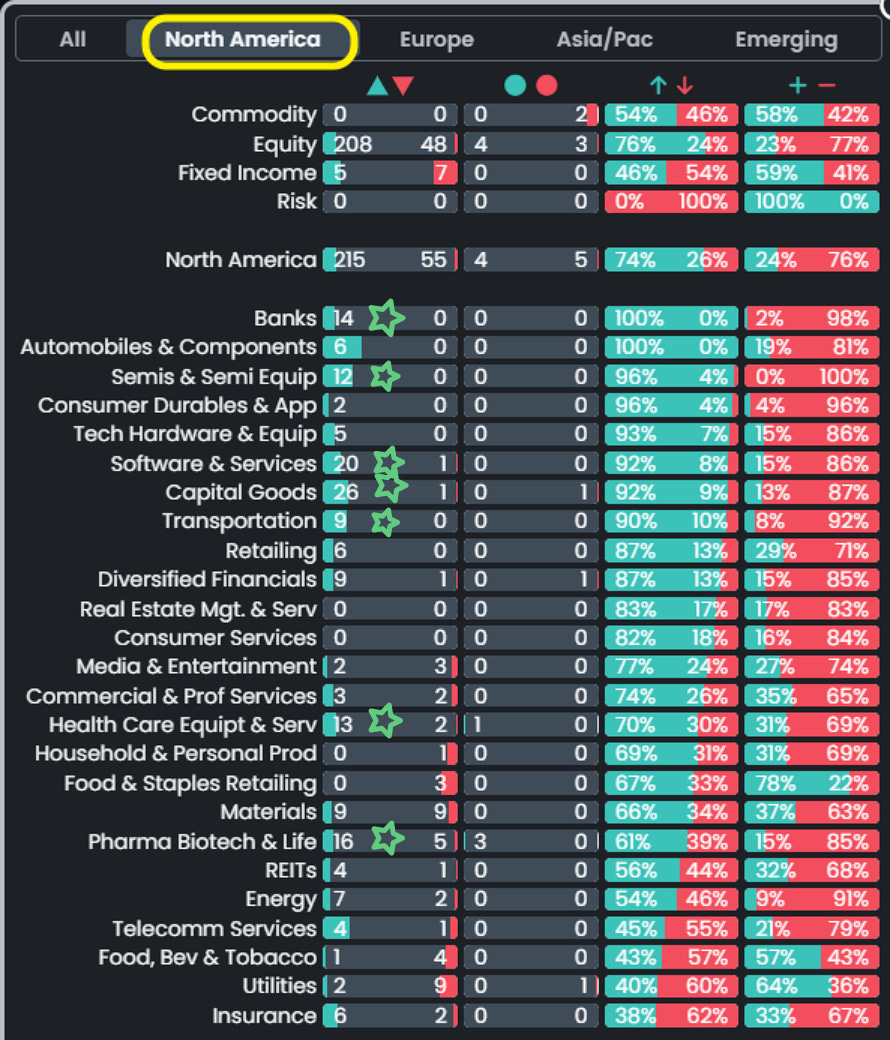

Positive Momentum Themes

Continued USD strength

Bullish clustering across U.S. equity sectors, especially:

Banks

Technology (Software & Semiconductors)

Consumer Durables

Autos

Negative Momentum Themes

Gold and Gold ETFs have shifted negative

Silver Spot and Silver Miners are now also under pressure

Summary

The US credit rating downgrade is the key development since markets closed and could trigger short-term volatility, as seen in previous downgrades. US bond yields are particularly vulnerable to a spike—contact us for key levels.

While this week showed a continued build in weekly positive signals and a decline in daily negative ones, the downgrade raises the question of whether the current bullish momentum will be disrupted. Both US and European markets appear increasingly prone to a near-term pullback.

As of Friday’s close, there were no major signs the broader rally is under threat, aside from the risk of a normal retracement. Now, the market’s reaction to the final agency downgrade will be key.