📈 Options Made Simple: What Is a Debit Put Spread

Featuring our recent META idea

Hello everyone,

Continuing our series on options strategies, we’re focusing this week on one of the most practical bearish approaches we use in QM Trades — the debit put spread.

For those still building confidence with options, this is a strategy you’ll want to have in your toolkit. It’s a simple way to take advantage of potential short-term pullbacks in a defined-risk, cost-efficient way.

🧠 What Is a Debit Put Spread?

A debit put spread is a defined-risk, bearish options strategy you can use when you expect a stock to move lower within a certain range. You don’t need a major breakdown — just a moderate pullback or drift lower is enough to make this work.

✅ How it works:

Buy a put option at a higher strike (this gives you the right to sell the stock at a higher price).

Sell a put option at a lower strike (this offsets some of the cost but caps your maximum profit).

Both options expire on the same date. Your total risk and reward are fully defined from the start.

💡 Why is it called a “debit” put spread?

It’s called a “debit” spread because you pay money upfront to open the trade. The net debit is simply the cost of buying the higher strike put minus the premium collected from selling the lower strike put.

This upfront payment is your maximum possible loss — so you know exactly what you’re risking before entering the trade.

📊 Risks and Rewards

Max Profit = Difference between strikes − Cost of trade

Max Loss = The upfront cost (net debit)

Break-even = Higher strike − Cost of trade

📝 What happens at expiration?

If the stock closes below the lower strike, you make the maximum profit.

If it finishes above the higher strike, both options expire worthless, and your loss is limited to the debit paid.

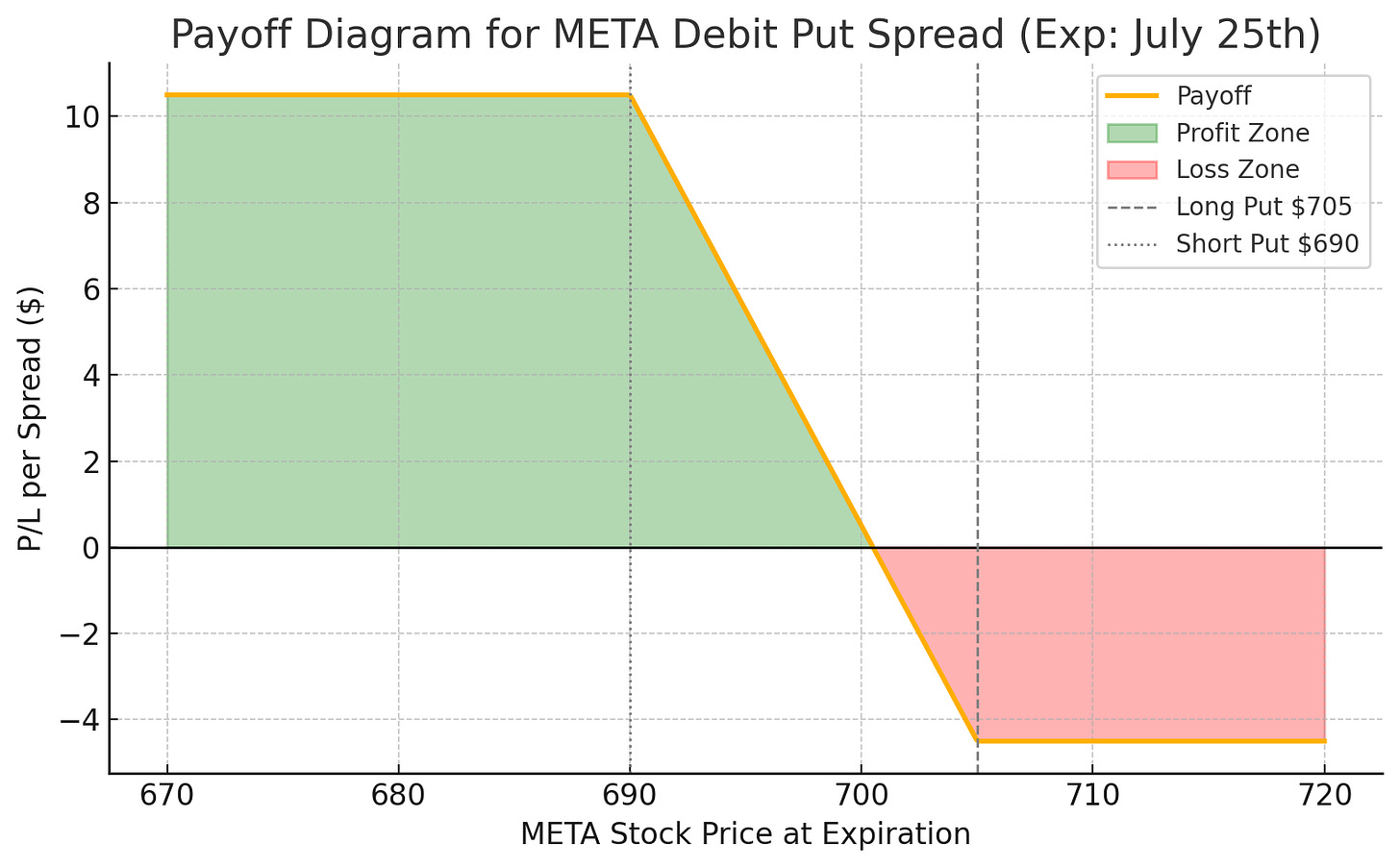

🔍 Real Example: META Trade from QM Trades

Here’s a recent example from QM Trades, using this strategy on Meta Platforms, Inc. (META).

Stock Price at Entry: $716.70

Bearish Thesis: We were looking for a short-term pullback to $703.59 and potentially $690.02, based on price structure and flow data.

Trade Setup:

Buy 1 META $705 put

Sell 1 META $690 put

Expiration: July 25th

Cost of trade (net debit): ~$4.50

Maximum Profit: $10.50

Maximum Loss (net debit): $4.70

Break-even Price: $700.30

🏷️ What does that mean?

Max Profit = $705 − $690 − $4.50 = $10.50 per spread

Max Loss = $4.50 per spread

Break-even = $705 − $4.50 = $700.50

As long as META closes below $700.50 at expiration, the trade moves into profit. If it closes below $690, we capture the full $10.50 reward on a $4.50 risk — offering more than 230% return on capital at risk.

⚠️ Risks to Keep in Mind

Even though this strategy limits downside risk, it’s not risk-free:

If META closes above $705, the spread expires worthless and we lose the $4.50 paid.

Profit is capped at $690, no matter how low META goes.

Time decay can work against you if the stock stays flat or moves down too slowly.

Still, this approach offers a defined-risk, cost-effective way to position for a pullback without the large capital outlay of buying a long put outright.

✅ Why Use a Debit Put Spread?

It’s ideal when:

You expect moderate downside, not a market crash.

You want to define both your risk and reward from the start.

You’re looking for a cheaper alternative to buying a naked put.

Final Thoughts

The debit put spread is a core strategy in the QM Trades playbook — and for good reason. It provides a balanced way to express a bearish thesis with controlled risk, manageable cost, and attractive return potential on directional trades like META.

We’ll continue highlighting and breaking down strategies like this whenever we spot great setups in our trade flow. If you’d like more examples or want to sharpen your execution, stick with us — and feel free to reply with any questions or requests.