🩺 Positivity in XLV: Healthcare Poised to Catch Up

The SPDR Healthcare ETF (XLV) is flashing a promising confluence of strength, with a mixture of daily 📈 and weekly 📊 positive signals — a technical alignment that often precedes meaningful inflections. After lagging the broader market for much of the recent rally, the sector now appears to be positioning for catch-up performance ⏫.

Here is the chart of relative performance of XLV versus the the S&P500

🔍 Why Now?

📆 Daily momentum indicators are turning higher, with price action breaking through key short-term resistance.

🗓 Weekly trend signals are stabilizing, hinting at a shift from consolidation to potential outperformance.

The sector’s defensive shield 🛡 and selective growth stories may attract flows in a rotational environment.

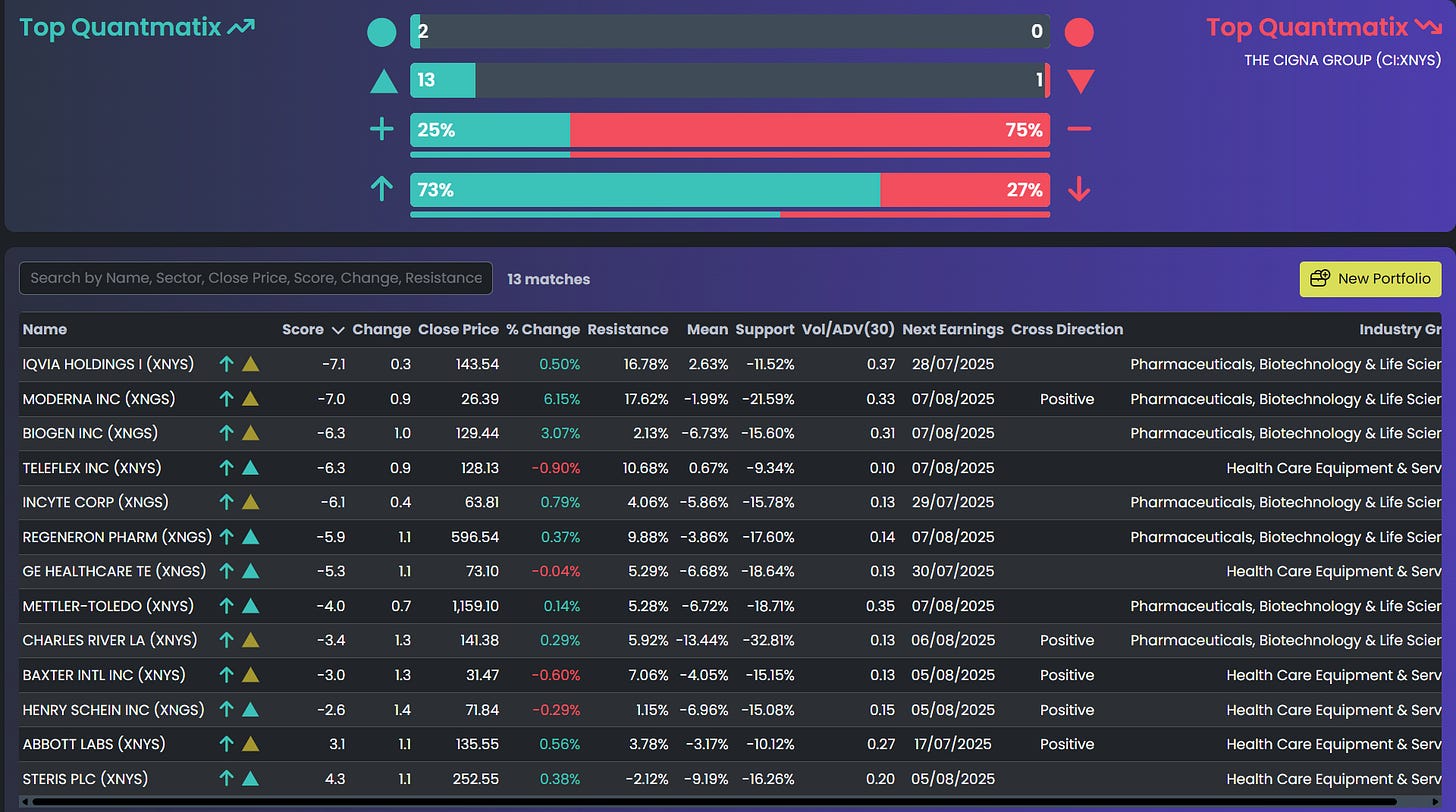

💡 Stocks to Watch

💊 Eli Lilly (LLY) – Remains a leadership name with strong trend and fundamental momentum.

🧬 Bristol-Myers Squibb (BMY) – Basing constructively; watch for breakout confirmation.

🩻 Baxter (BAX) – Reversing higher from oversold conditions.

🧫 Moderna (MRNA) – Volatile but showing signs of a base with upside potential.

🎯 With momentum building and broader participation starting to take hold, XLV has scope to move toward the $144 level — a meaningful resistance zone and potential milestone in its catch-up to the broader market.