📈 US Equities: Positive Reversal Signals Building Across Time Frames

Things are looking up

After several weeks of stretched conditions and cautionary signals, the US equity market is showing continuing signs of strength. The S&P 500 Index (SPX) has posted a positive reversal last week, with the Quantmatix scores improving on both the Daily and Weekly time frames — a constructive shift in tone that warrants attention.

✅ Picture is still Improving

68% of stocks in the S&P 500 now show improving Q scores on the Weekly time frame, a strong breadth signal that supports the broader trend. This follows 210 weekly positive reversal over the last 4 weeks with a further 41 pending this week.

🔍 Market Structure: Trading Bands Framework

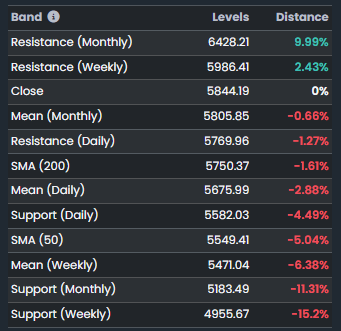

We continue to monitor price action relative to key volatility-adjusted trading bands:

Current positioning is well within Weekly ranges, but there are 220 stocks outside the Daily volatility resistance. While there may be some more near term upside we would expect this to consolidate and come back inside the dynamic volatility bands over the next week.

Bottom Line:

The US equity market is in a clear weekly uptrend and there is no evidence yet of it stalling.

NB. The move yesterday has taken it outside the top of the volatility bands. Watch for some consolidation.