📉 US Insurance Sector Under Pressure

Cracks Widening Across the Board

The US Insurance sector is flashing serious warning signs, both in absolute and relative terms. If you’re watching the financials, it’s time to zoom in — because the Insurance group is breaking down. Here's what we're seeing:

🚨 Relative Weakness: Trouble vs. the Broader Market

On April 4th, the SPDR Insurance ETF (KIE) posted a short term daily negative reversal on Quantmatix relative to SPX — a key early signal that the group was starting to underperform the broader market.

Since then, the trend has only deteriorated:

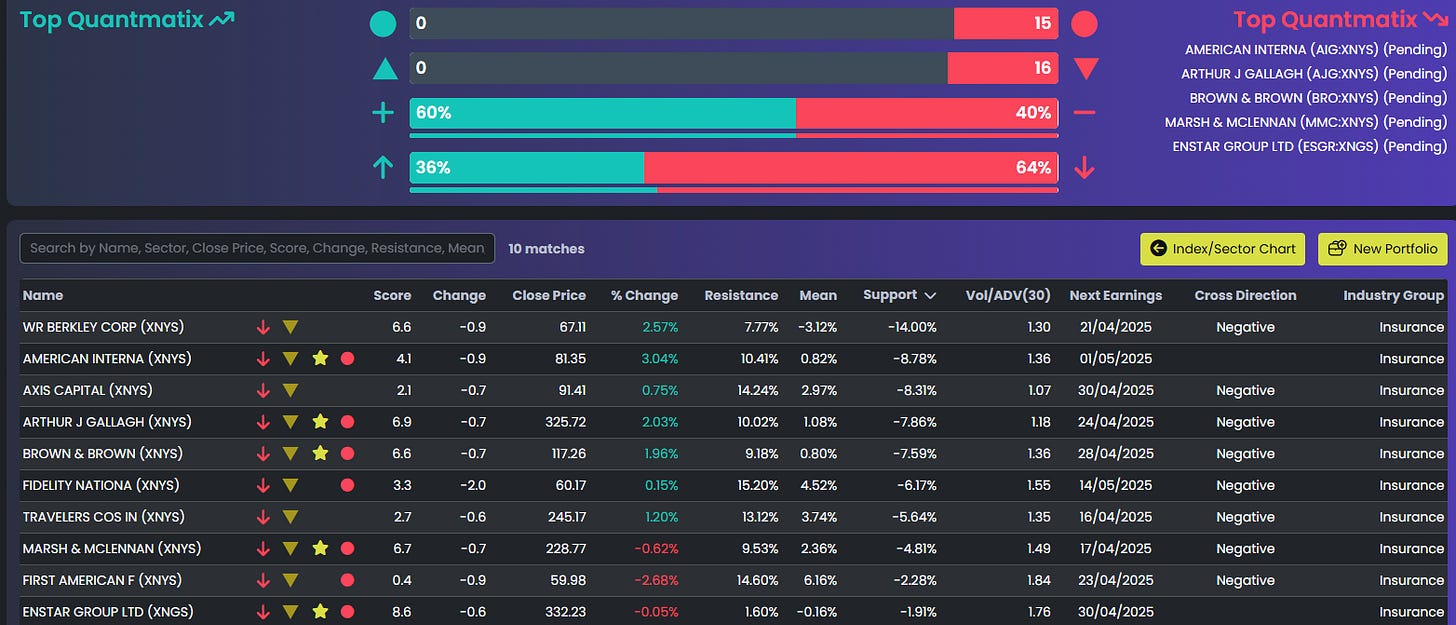

Of the 47 constituents in the KIE ETF, a striking 46 are moving negatively on a daily timeframe.

37 names now carry a negative score based on our proprietary ranking system.

That’s an overwhelming majority — and a clear sign this isn’t just a few outliers dragging things down. This is broad-based weakness.

🕰️ Medium-Term (Weekly) View: The Pain Is Spreading

Zooming out to the weekly timeframe, the picture still looks grim:

30 out of 47 constituents are moving in a negative direction.

We've seen 6 confirmed reversals already — with another 10 names hovering on the edge (see image below), looking primed to flip.

Momentum is fading, and structural cracks are forming across the space.

🧨 What This Means

This is not just noise — the Insurance sector, typically viewed as a defensive stalwart, has been outperforming since mid February but this may be about to change. Both absolute performance and relative strength are breaking down, which raises broader concerns for financials as a whole.

We’ll continue to monitor developments, but for now:

🔍 US Insurance is a sector to watch — or possibly avoid — until the dust settles.